HIV COMMUNITY EMERGENCY ON TAX BILL

Updated December 17, 2017

Updated December 17, 2017

A final version of the #GOPTaxScam was released on Friday, December 15th and a vote is expected as early as Tuesday, December 19th. Make no mistake, this bill remains a declaration of class warfare and a direct attack on health care. Click here to read about what’s in it and then take action now.

What’s in the final version of the bill? The “Tax Cuts and Jobs Act” represents the largest one-time reduction in the corporate tax rate in U.S. history, from 35 percent down to 21 percent. It also includes a new tax cut for the very richest. It removes the Affordable Care Act’s individual mandate, which will drive up costs of insurance premiums and leave 13 million uninsured.

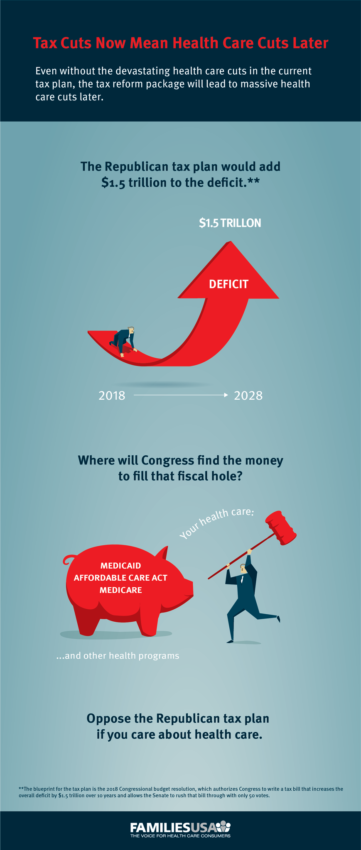

If the tax bill passes, billions will likely get cut in funding for programs that benefit people who are working and middle-class, living in high-tax rate states, have pre-existing conditions, and who use safety net programs, like Medicaid and SNAP (food stamps). Republicans have been pushing these cuts solely to fund tax breaks for corporations and the ultra-wealthy.

At the same time, Congress has not yet acted to protect the nearly 700,000 undocumented immigrant youth at risk for deportation by passing a new DREAM Act. Your Senators need to hear from you on both of these issues today!

PWN hosted a webinar on the #GOPTaxScam on December 4th. Watch the recording here. Download the slides here.

What’s at Stake?

- Health care. As part of the Republican administration’s attempt to dismantle affordable health care coverage, the Senate tax bill eliminates the individual mandate of the ACA. The mandate requires that people have health insurance coverage or face a penalty. Without it, millions of people will drop out from the insurance market, destabilizing it and driving up the price of premiums for everyone else including people with pre-existing conditions. An estimated 13 million people would lose coverage by 2027 under this bill.

- Everything else we depend on! The House tax bill would cut $25 billion from Medicare in 2018, with an additional $5.8 trillion in cuts over the next ten years to Medicare, Medicaid, and Social Security.

What Do We Need to Do?

We only have hours to kill this bill.

Join us to show a strong force of opposition from our community to the #GOPTaxScam! Contact your Members of Congress now by calling 202-335-5529.

Call this number 202-335-5529 now. We will connect you with your Member of Congress. Press * at the end of every call to automatically advance to the next call.

Sample Script: “Hello, my name is ____]. I’m a person [living with HIV/concerned about] healthcare. The tax bill would repeal the individual mandate and increase pressure to gut essential safety net programs like Ryan White, Medicare, and Medicaid in future budgets. I demand that you VOTE NO on the tax bill! In addition, I demand that you pass a DREAM Act to protect undocumented immigrants. Can I count on your support?”

Want to do more to stop this terrible bill? Organize a phone bank. Get everyone you know together to call the target Senators and tell them we oppose the Tax Bill! Here are some tips on organizing a phone bank: HIV Tax Bill Phone Bank Tipsheet. You can use this tool to easily take action.

Organize a phone bank. Get everyone you know together to call the target Senators and tell them we oppose the Tax Bill! Here are some tips on organizing a phone bank: HIV Tax Bill Phone Bank Tipsheet. You can use this tool to easily take action.- Find a town hall with your Member of Congress

- Join planned actions across the nation with Indivisible and Americans for Tax Fairness

- Go visit your Senators.

- Get everyone you know to make calls.

- Check out this great action toolkit, including press tips, event signs, and social media tools: http://stoptrumptaxcuts.org/

- For resources on planning a visit with your Member of Congress about the #TrumpTaxScam, click here

- The tax bill hurts middle and low income communities, while benefiting the wealthiest individuals and corporations.

- The final version of the tax bill repeals the individual mandate of the Affordable Care Act.

- The tax bill will lead to massive cuts in federal spending, including a projected $28 billion cut to Medicare in fiscal year 2018. Over the next 10 years, it includes $1.3 trillion in cuts to Medicaid, on which 44% of people living with HIV rely.

- Women and families across the country would be penalized by the elimination of critical tax benefits that support millions of people and their families (information provided from National Women’s Law Center and the National Partnership for Women and Families)

- The House tax bill would eliminate the deduction for medical expenses, jeopardizing the financial security of people who have serious medical conditions and their families, as well as seniors in need of long-term care

- The House tax bill actually cuts existing tax benefits for child care. The bill would eliminate child care tax benefits for families, including the exclusion of Dependent Care Assistance Plans (DCAPs) from income, beginning in 2023. Additionally, the tax bill eliminates the tax credit for employers that offer child care benefits to their employees, effective immediately.

- The Senate tax bill would completely eliminate the deduction for state and local taxes. Eliminating this tax benefit would not only raise taxes for millions of women and families, but it would also make it more difficult for states and localities to sustain the tax rates necessary to fund essential public services and maintain the jobs of public sector employees, the majority of whom are women and a substantial share of whom are people of color.

- Both tax bills add a new requirement of providing a Social Security Number for each child claimed for the refundable portion of the Child Tax Credit (CTC)—which could exclude a significant number of children in immigrant families while immediately making families with six-figure incomes eligible to claim the CTC.

- More talking points on the effects on Medicaid are here.

Tax Bill Background and Analysis:

- The GOP Tax Bill May be the Worst piece of Legislation in Modern History

- Joint Committee on Taxation says tax cuts will cost the federal government $1 trillion over the next 10 years

- Families USA calls on House of Representatives to Save Healthcare

- “Tax Benefits for Corporations and Super Wealthy, and Pain for Everyone Else,” NHeLP response to tax bill passage

- “The Tax Scam Passed The Senate, What Now?” a breakdown on what is expected in the coming week now that the tax bill goes to conference

- National Women’s Law Center explains how cutting the individual mandate means cutting affordable healthcare for women

- “Don’t Rob Medicaid & the ACA to Pay for Tax Cuts,” blog from NHeLP managing attorney Mara Youdelman.

- Resources and talking points regarding how the GOP tax plans would negatively impact people with disabilities, from the Center for Public Representation.

- The Center on Budget and Policy Priorities’ (CBPP) “Senate Tax Bill Would Add 13 Million to Uninsured to Pay for Tax Cuts of Nearly $100,000 Per Year for the Top 0.1 Percent,” and “Senate Budget Plan Threatens Health Programs.”

- The Center on Budget and Policy Priorities’ (CBPP), Senate GOP Tax Plan Raises Taxes on Middle and Lower Income, Adds Millions to Uninsured, to Pay for Corporate Tax Cuts

- The National Immigration Law Center on how the Republicans’ tax plan end tax credits for immigrant families and their children.

- CBPP’s social media graphics on the Republicans’ tax plans, and use hashtags on Twitter, such as #NotOnePenny, #TrumpTaxScam, #GOPTaxPlan, #HandsOff.

- Families USA on why The Affordable Care Act’s Individual Mandate Helps Make Health Insurance Affordable and Available

- National LGBTQ Task Force and National Center for Lesbian Rights, Congressional Tax Plans: What Do They Mean for LGBTQ People?

Social Media – use these images

Facebook:

Instagram:

Twitter:

State-by-state Medicaid graphics

State-by-state uninsured numbers graphics

Facebook Images:

State-by-state Medicaid graphics

State-by-state uninsured numbers graphics