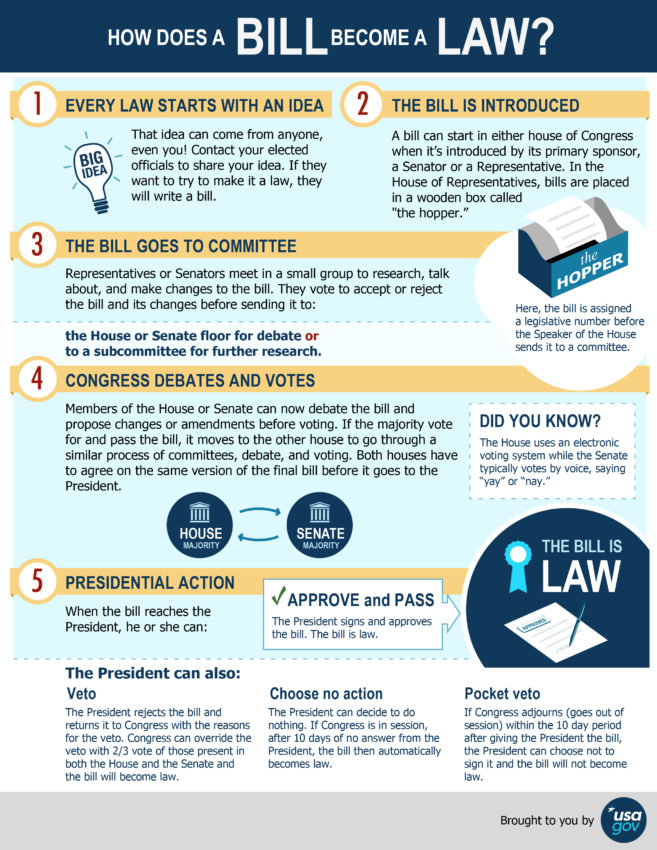

Legislative advocacy: break the law, remake the law.

When we think about policy, we often think about advocating with legislators first. Here you’ll find resources on how to influence, change, repeal (get rid of), or even help write and create legislation.

It’s important to know which level of government is responsible for what to make sure that we know who we need to target our advocacy efforts on. For example, it’s pretty much useless to ask our Congressperson or U.S. Senator to expand Medicaid in our state: That’s a decision made by state government. Same for HIV criminalization laws: These are state-by-state, and if we want to change the laws in our state, the most important lawmakers to address the issue with are state legislators. Our members of Congress won’t be able to help us, and talking to them about it is not a great use of their time or ours.

In the recorded webinar below, presenters discuss the differences and similarities between state and federal advocacy, and which laws and policies are decided at which level. You can download the slides here. And find information about your state’s legislative session dates here.

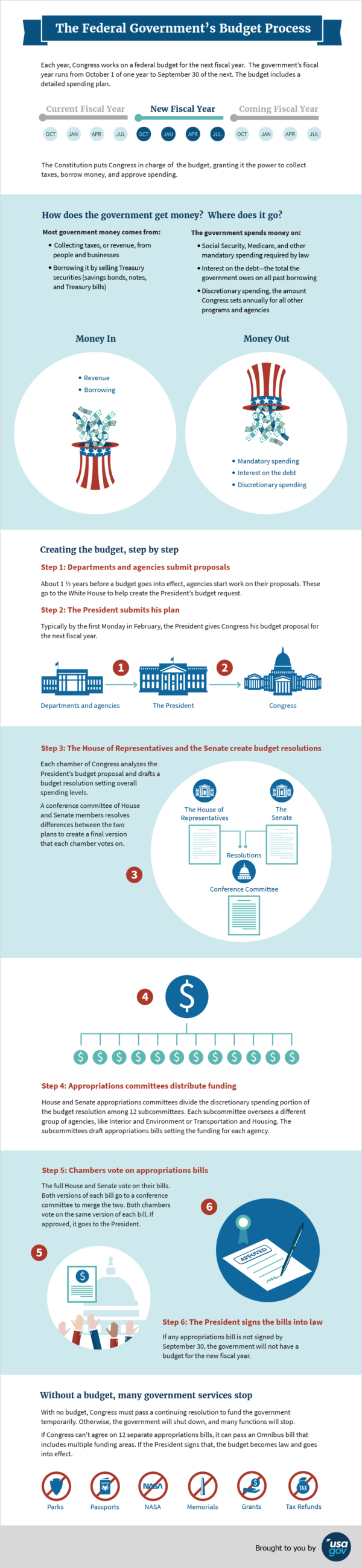

Budget advocacy: the hand that holds the purse writes herstory.

The budget process can seem overwhelming, but it doesn’t have to be. We have tools to demystify all of the steps and procedures.

Download and print this glossary for future reference here

Budget Glossary

*created by Suraj Madoori

A

Actual Spending: spending reported by the president after the end of a fiscal year. Actual spending is different from requested spending because it reflects the spending priorities approved by Congress during the annual appropriations process.

Apportionment: divides money available for obligation by specific time periods (usually quarters) for activities, projects, or programs. Example: you only get money every 3 months.

Appropriated Amount: refers to the budget authority granted by Congress. (See also requested amount.) Example: the budget authority allows for around $2.3 billion for Ryan White every year.

Appropriation: is a law that authorizes the expenditure of funds for a given purpose. Example: Language in funding syringe exchange says that funding cannot be used for purchasing syringes

Appropriations Bill: A bill that specifies how much money can be spent on a given federal program. Reviewed by Appropriations subcommittees in both the House and Senate, appropriations bills must also be approved by the full House and Senate before being signed by the president to become law.

Appropriation Rider: is usually an amendment that’s attached to the main appropriations bill used to refer to either a provision that is not directly related to the appropriation to which it is attached, or a limitation or requirement in an appropriation act. Example: policy riders have been attached calling federal funding to Planned Parenthood to either be completely defunded or funds strictly not used for family planning/abortion services. Sometimes this is an attempt to delay passing a bill or force a negotiation.

Appropriations Committees: House and the Senate committees that are responsible for determining the precise levels of budget authority for all discretionary programs.

Appropriations Process: The annual process through which Congress creates the discretionary budget.

Appropriations Subcommittees: are made up of members of the full Appropriations Committee. Each of these subcommittees has jurisdiction over funding for a different area of the federal government. In both the House and Senate there are 12 different Appropriations subcommittees with the following areas of jurisdiction (*work on some or very specific HIV funding issues):

- Agriculture, Rural Development, and Food and Drug Administration*

- Commerce, Justice, and Science*

- Defense

- Energy and Water (E&C)

- Financial Services and General Government

- Homeland Security

- Interior and Environment

- Labor, Health and Human Services, and Education* (LHHS or Labor-H)

- Legislative Branch

- Military Construction and Veterans Affairs

- State and Foreign Operations* (SFOPS)

- Transportation, and Housing and Urban Development* (T-HUD)

Authorization Bill: gives a government agency the legal authority to fund and operate its programs. An authorization bill also sets maximum funding levels and includes policy guidelines. Government programs can be authorized on an annual, multi-year, or permanent basis. The specific amounts of money authorized in an authorization bill serve as limits on the amounts of money that subsequently may be appropriated by Congress, though lawmakers can choose to appropriate less than the amounts authorized. For example (non-HIV): the Comprehensive TB Elimination Act authorizes up to $243 million, but Congress has chosen to appropriate only $124 million (for the past 10 years).

B

Baseline: estimate of spending, revenue, the deficit or surplus, and the public debt expected during a fiscal year under current laws and current policy. It’s a starting point to figure out how much you have, how much money you have coming in and will spend over a year.

Balanced Budget: is a budget in which revenues and spending are equal in a given year.

Balanced Budget Amendment: An amendment to the U.S. Constitution that would require the federal government to enact a budget where expenditures do not exceed revenues in any fiscal year.

Budget Authority: is the federal government’s legal authority to spend a given amount of money for a certain purpose, according to laws passed by Congress and signed by the president.

Budget Control Act of 2011: is legislation that passed in August 2011. It raised the debt ceiling, narrowly averting a debt crisis. But also placed caps on discretionary spending for 10 years; and set up an additional deficit reduction target to be achieved by a super committee or through automatic spending cuts known as sequestration. Also called (BCA)

Budget Resolution: a non-binding resolution passed by both chambers of Congress that serves as a framework or guidance for budget decisions. It sets overall spending limits but does not decide funding for specific programs.

C

Chair’s Mark: The first draft of legislation introduced by the chair of a committee or subcommittee that is then debated and amended by committee colleagues. This ability to decide the starting point for all further work on a piece of legislation is an important part of the chair’s power.

Conference: refers to members of the House and Senate coming together to reconcile their two different versions of a given piece of legislation. This often happens when trying to finalize the budget numbers and allocations.

Conference Committee: Members of the House and Senate who work together to reconcile differences in their respective versions of a bill. Both the House and Senate must pass identical versions of any legislation before it can be signed into law by the President.

Conference Report: The final product of conference committee work, the report documents the changes made by conferees (i.e. what is taken out of which bill, etc).

Congressional Budget Office: also called CBO, is the non-partisan branch of Congress that provides analysis and materials related to the federal budget process, and objective analyses needed for economic and budgetary decisions related to programs covered by the federal budget. Keith Hall is the Director of the CBO.

Continuing Resolution (CR): is a piece of legislation that extends funding for federal agencies – typically at the same rate that they had been previously funded – into a new fiscal year until new appropriations bills become law. Example: FY17 saw two CR’s that extended it until the end of April to finalize the budget.

D

Debt Ceiling: is the limit on the amount of debt the federal government allows itself to hold. Congress has the authority to raise the debt ceiling. Think of it as a credit card limit.

Debt Held by Federal Accounts: money the federal government borrows from itself. It results from the Treasury using surpluses from some accounts – for instance, Social Security – to buy Treasury bonds, and thus finance current government spending. Borrowed funds ultimately need to be repaid to the original account, with interest.

Deficit: is the amount by which government expenditures are greater than tax collections in a given year. Example: spending more than you make

Disbursements: Actual payments made by the U.S. Treasury to recipients of a federal agency’s Obligations. Also see Outlays.

Discretionary Spending: is the portion of the budget that the president requests and Congress appropriates every year. It represents less than one-third of the total federal budget, while mandatory spending accounts for around two-thirds. All HIV programs come under discretionary spending.

E

Earmarks: are provisions added to legislation to designate money for a particular project, company, or organization, usually in the congressional district of the lawmaker who sponsored it. In 2010, the House of Representatives instituted rules to severely limit earmarks. Example: some NIH money will be earmarked to fund Joe Biden’s cancer moonshot

Entitlement Programs: term that refers to a certain kind of federal program in which all people who are eligible for the program’s benefits, according to eligibility rules written into law, must by law receive benefits if they apply for them. Entitlement programs may also be referred to as earned benefit or social insurance programs. Example: Medicaid, a health care program is considered an entitlement program. Entitlement programs are often the target for deficit reduction.

F

Federal Debt: the total of all past federal budget deficits, minus what the federal government has repaid.

Federal Funds: refers to tax revenue collected by the federal government for general purposes. These are distinct from trust funds, which are collected by the federal government for specific purposes, such as Social Security.

Fiscal Policy: refers to decisions made by the federal government regarding government spending and taxation. Example: President wants to introduce a new tax code that will change fiscal policy.

Fiscal Year: The federal fiscal year runs from Oct. 1 through Sept. 30. For example, fiscal year 2017 runs from Oct. 1, 2016, through Sept. 30, 2017. Sometimes you’ll see it written as FY17 or FY 17.

G

Government Accountability Office (GAO): is an independent, nonpartisan agency that works for Congress. GAO operates as an auditor of the federal government, and investigates how the federal government spends taxpayer dollars. The head of GAO is the Comptroller General of the United States (Eugene Dodorio is the current Comptroller General). Also called the “Congressional watchdog”.

H

House Committee on the Budget: the committee in the U.S. House of Representatives that is responsible for writing a budget resolution, among other responsibilities. It became a standing committee with the passage of the Congressional Budget and Impoundment Control Act of 1974.

I

Income Security & Labor: refers to programs like job training, disability, retirement, unemployment insurance and Social Security that promote employment and income security. Positive Working Coalition does a lot of work in this area.

Interest on Debt: is the interest payments the federal government makes on its accumulated debt, minus interest income received by the government for assets it owns.

L

Line Item: is particular expenditure, such as program, subprogram, or project. Example: the line item for Ryan White Part C is $40 million

M

Mandatory Spending: is federal spending that is spent based on existing laws rather than the budgeting process. For instance, spending for Social Security is based on the eligibility rules for that program. Mandatory spending is not part of the annual appropriations process. It is usually set in stone and automatic.

Medicare: a federal program that provides health care coverage for senior citizens and the disabled. It is funded through payroll taxes.

Monetary Policy: Monetary Policy refers to actions by the Federal Reserve to influence the supply of money in the economy as well as interest rates. You’ll often hear the “feds” have raised interest rates.

Multiplier Effect: is an economics term for an increase in overall economic activity that is a consequence of an initial increase in spending. For example, if the government builds a new bridge in a small town, the increased incomes of those who work on the bridge will boost their spending at local stores, and the owners of those stores will then also see an increase in income as a result. This is an effective policy framing strategy.

N

Net Federal Debt: Includes both debt and assets, and therefore appears smaller than the actual “Gross” debt. How much you owe – how much you own = net debt

O

Obligations: are binding financial agreements entered into by the federal government. Examples of obligations include contracts and the hiring of federal workers. Obligations are part of the process of federal spending. The federal budget creates budget authority to spend money for certain programs; then those programs enter into obligations to spend that money; and finally the Treasury spends the money, which is known as outlays.

Office of Management and Budget (OMB): is part of the executive branch of government. OMB gives guidelines to federal agencies instructing them how to prepare their strategic plans and budgets. It also serves as the president’s accounting office. Currently led by former Congressman Mulvaney.

Omnibus: a budget that encompasses all 12 appropriations bills into one bill, often used when Congress and the President can’t agree on passage of 12 individual spending bills. This happened with the FY17 budget because Congress was very delayed in passing a spending bill.

Opportunity Cost: is what you give up when making a decision, measured in terms of the next best alternative. This is something you have a consider when you do budget advocacy, how will people with HIV be impacted by a particular decision or ask?

Outlays: money paid out by the U.S. Treasury; they occur when obligations are actually paid off, primarily by issuing checks or making electronic fund transfers. This is also called an expense.

P

Poverty Line: Also called poverty level or the poverty threshold, the poverty line is determined by annual income. For example, the poverty line for a family of four was $22,113 in 2010; any family of four earning that amount or less was considered to be in poverty. This can be used to

President’s Budget: is the annual spending proposal, also known as the budget request, released by the White House each February. It represents the administration’s priorities as reflected in the specific funding requests of various federal agencies. It is the starting point for the annual budget process, but it is not legally binding. It often points to the priorities of the current administration. This year’s budget came late, released as something called a “skinny budget” in April. The full budget will be released in late-May. Right now the budget is prioritizing defense (military, army, navy, etc.) over non-defense (like health care).

Projections: Estimates of budget authority, outlays, revenue, or other budget amounts extending several years into the future. Projections are generally intended to indicate the budgetary implications of existing or proposed programs and legislation. Projections may include alternative program and policy strategies. Example: a projection of the American Health Care Act finds that 24 million people are at risk of losing insurance if the bill is passed.

R

Reauthorization Legislation: that renews an expiring or expired authorization that was in effect for a fixed period, with or without substantive change. Example: Ryan White reauthorization means that Congress needs to revisit the program for it to be funded at the same levels or increased.

Reprogramming: Shifting funds within an appropriation to use them for purposes other than those at the time of appropriation. Example: shifting money from abstinence only programming to STI prevention.

Request: annual budget request is the president’s budget proposal to Congress, which is due, by law, on the first Monday of February each year for the coming fiscal year, which begins on Oct. 1. This year it will come out in late-May.

Requested Amount: refers to the amount requested by the president as part of the annual budget request at the start of the budget process. Example: President is requesting more money for defense spending.

Revenues: funds flowing into the U.S. Treasury from such things as individual and corporate income taxes, payroll taxes and user fees (also referred to as receipts). Example: your yearly taxes are “revenue” for the government to invest into important social and health care programs.

S

Senate Committee on the Budget: is the committee in the U.S. Senate that is responsible for writing a budget resolution, among other responsibilities. It became a standing committee with the passage of the Congressional Budget and Impoundment Control Act of 1974.

Sequestration: is the term for automatic, across-the-board spending cuts triggered by legislation limiting discretionary spending. Most recently, the Budget Control Act of 2011 included budget caps that went into effect in 2013 and will continue through 2021 unless Congress passes new legislation to stop them. If Congress does not abide by the spending caps during the appropriations process, spending will be automatically reduced through across-the-board, indiscriminate cuts known as sequestration. You’ll often hear Congress trying to raise the debt ceiling or make cuts to specific programs.

Social Insurance: is made up of programs that help workers and their families replace part of income lost due to unemployment, disability, retirement, or death, as well as ensure access to adequate health care.

Social Security: officially called the Old Age, Survivors, and Disability Insurance program, is a federal program that is meant to ensure that elderly and disabled people do not live in poverty. It is funded through payroll taxes.

Spending caps: overall limits on discretionary spending (like public health programs, education, etc.)

Subsidy: direct assistance from the federal government to individuals or businesses for certain activities, which helps defray the costs of those activities. Example: the Affordable Care Act offers subsidies which helps allow PLHIV to pay for insurance.

Super Committee: The Joint Select Committee on Deficit Reduction, known widely as the super committee, was created by the Budget Control Act of 2011. The super committee was comprised of six senators and six representatives evenly divided between Democrats and Republicans. They were tasked with finding a minimum of $1.2 trillion in deficit reduction to be implemented over 10 years. Because the super committee failed to complete this task by the established deadline of Nov. 23, 2011, across-the-board cuts known as sequestration went into effect.

Supplemental Appropriation: is legislation that provides funding beyond what was appropriated in the regular budget process. Congress typically passes supplemental appropriations in response to emergencies like a natural disaster.

Surplus: is the amount by which revenues exceed expenditures in the federal budget. The federal government has only run a surplus in four years in the last half century, from 1998 to 2001 – it’s been a long time!!

T

Trust Funds: are funds collected by the federal government for specific purposes, as designated by law. For example, payroll taxes are trust funds collected by the federal government to pay for the Social Security and Medicare programs.

Administrative advocacy: how to influence law without the legislature

Shhh, there’s a secret source of law that we don’t always talk about: administrative regulations. It’s law that is made by federal (administrative) agencies instead of Congress or your state legislature.

Fortunately for you, PWN has unpacked that process for you. Watch the webinar below and check out our detailed factsheet here.

All good with Part 2? Click here to move on to Part 3: Planning and executing your campaign